salt tax deduction limit

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

The Tax Cuts and Jobs Act TCJA limited the amount an individual can deduct from the amount of the following state and local taxes they.

. If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. This will leave some high-income.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Previously the deduction was unlimited. Ad All Major Tax Situations Are Supported for Free.

Learn how to maximize your impact with a Schwab Charitable donor-advised fund. The SALT deduction applies to property sales or income taxes already paid to state and local governments. The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions.

Free means free and IRS e-file is included. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Discover Helpful Information And Resources On Taxes From AARP.

To be impacted by the limit 3. The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. The new proposal from the Democrats raises.

Its not an issue of red states. Since the SALT cap was put into. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000.

The SALT limit really put an unfair burden on all of our cities. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. Tom Suozzis defense of uncapping the 10000 state-and-local-tax deduction is all wrong Letters Aug.

There is talk that the SALT deduction limit will be. But you must itemize in order to deduct state and local taxes on your federal income tax return. 52 rows The state and local tax deduction commonly called the SALT.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. The TCJA lowered tax rates and expanded the standard deduction to 12000 for single filers.

The change may be significant for filers who itemize deductions in. Using Schedule A is commonly referred to as itemizing deductions. Listen to article.

What is the SALT deduction limit. Before the creation of a cap on this deduction 91 of the benefit. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

The Tax Cuts and Jobs Act. The federal government enacted a. 54 rows The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income.

Start Your Tax Return Today. Second the 2017 law capped the SALT deduction at 10000 5000 if. This includes the SALT deduction.

Max refund is guaranteed and 100 accurate. While the federal standard deduction nearly doubled there have been cuts and limits on certain itemized deductions. The SALT deduction limit was part of a larger change to the individual income tax.

Senate Republicans Slam Salt Cap Proposal U S Senator Mike Crapo

What Is Salt The Popular Tax Break Is Threatening To Derail Trump S Tax Bill Npr

Democrats Consider Salt Relief For State And Local Tax Deductions

Democrats Consider Salt Relief For State And Local Tax Deductions

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

10 Spring Cleaning Hacks With Ingredients You Probably Already Have Infographic Ecogreenlove Spring Cleaning Hacks Cleaning Hacks Spring Cleaning

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Your Guide To 2021 Tax Deductions

Irs Explains Tax Treatment Of State And Local Tax Salt Refunds Tax Pro Center Intuit

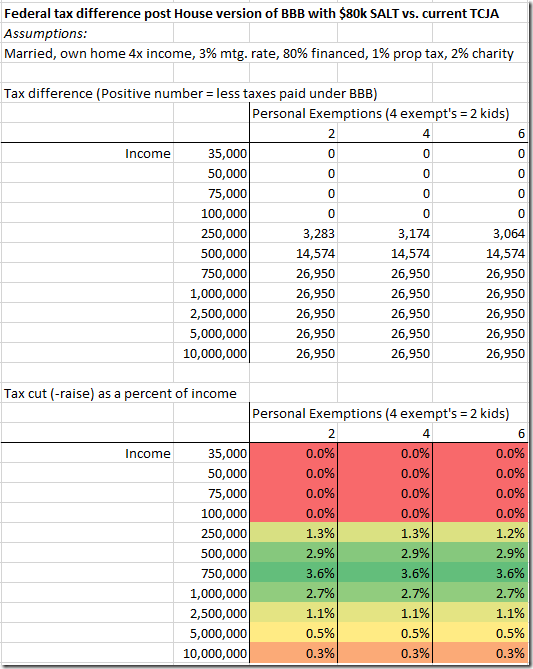

Personal Finance Archives Spreadsheetsolving

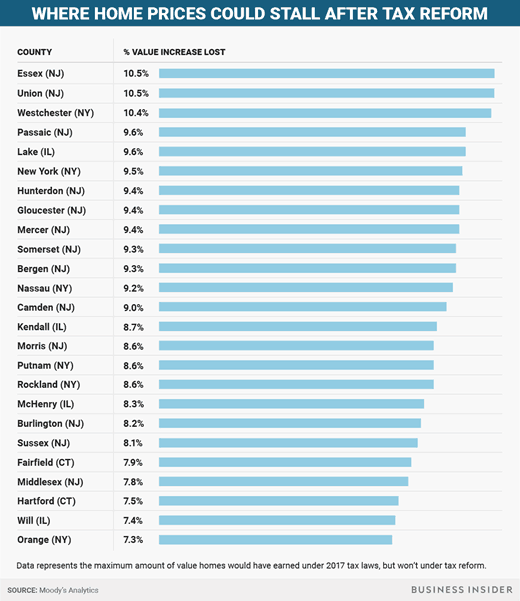

How Much Will The Value Of Your House Drop Under The New Tax Law Greenbush Financial Group

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

What Is Salt The Popular Tax Break Is Threatening To Derail Trump S Tax Bill Npr

Rx For High Salt Investors Municipal Bonds Envestnet Institute

Avalara Automated Sales Tax Software Tax Software Automation Software

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Senate Democrats Beat Back Gop Efforts To Further Cap N J Property Tax Break Nj Com

The House S Salt Cap Proposal Is Bad Policy And Bad Politics Opinion

House Dems Propose Lifting Salt Deduction Cap Amid Spending Debate Youtube