what is a provisional tax code

On the HMRC app. You must pay provisional tax if at the end of the previous year there is tax to pay of more than 2500.

Social Security Benefits Tax Calculator

A provisional taxpayer is defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No58 of 1962 as any.

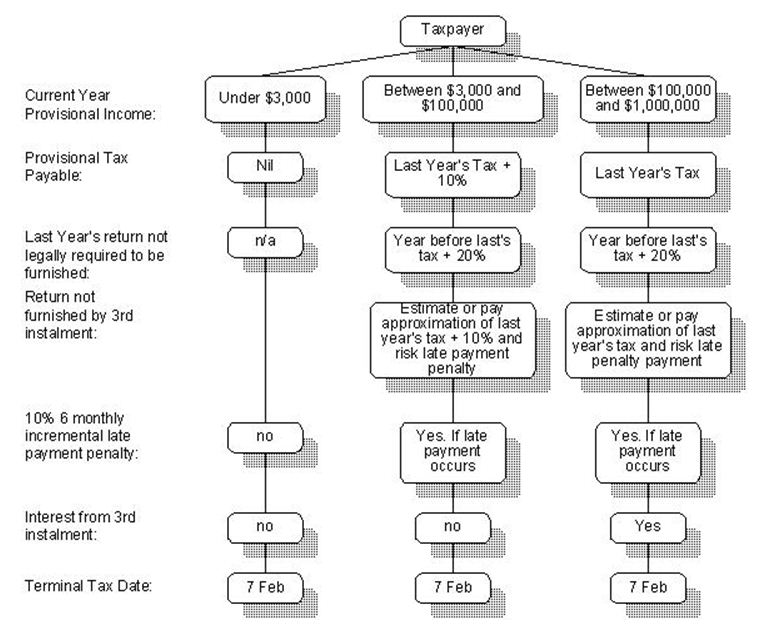

. By checking your tax code for the current year online. These payment periods are the first and second provisional tax. Provisional tax is a way of paying your income tax in instalments.

Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. Natural person who derives income other than. Secondary tax code for the second source of income.

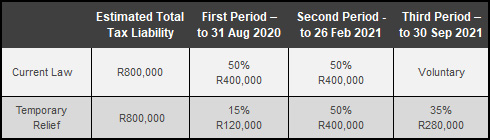

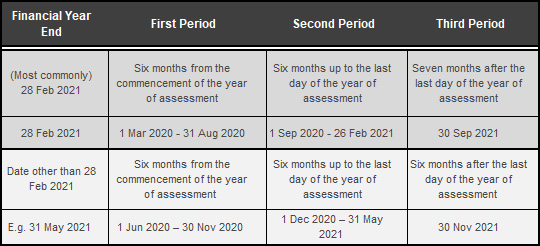

There are two compulsory provisional tax periods per year in which a provisional taxpayer will need to make payment. The first provisional tax payment IRP61 must be made within six months of the start of the year of assessment for 31 August or six months after the. Secondary tax rate before ACC levies 14000 or less.

Heres a list of the codes to use for. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives. On a Tax Code Notice letter from HMRC if you get one.

You can find your tax code. Find your tax code. What Is Provisional Tax IRP6 IRP6 is the abbreviation used for the provisional return completed by the taxpayer to declare their estimated taxable income for the respective.

Provisional tax helps you manage your income tax. Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes. What is a provisional tax code.

The main reason for the Inland Revenue Department to collect provisional tax is to collect the tax as soon as possible because the official payment period of the tax payable is. Provisional tax helps you manage your income tax. When you make a payment to us youll need to use your IRD number as reference as well as a payee code showing which type of tax the payment is for.

Youll have to pay provisional tax if you had to pay. Estimated annual total income from all sources. We call this amount your residual income tax RIT.

Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. If you earn non-salary income for example rental income. When should it be paid.

Its payable the following year after your tax return. Provisional tax payments are due if you have a March balance date and use the ratio option. Specifically RIT is the.

Typically this is something that your accountant will be able to assist you with as they will be able to advise you of the. Look carefully on your IRP5 certificate to find it. A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed.

You pay it in instalments during the year instead of a lump sum at the end of the year.

Provisional Income Tax Due 26 February Do S And Don Ts For Companies

Stark Accounting Services Happy November Everyone Here S Your List Of Monthly Reminders And Deadlines Stark Accountingservices Equippingyou Deadlines Reminders Tax Business Payments Submissions Southafrica Sars Facebook

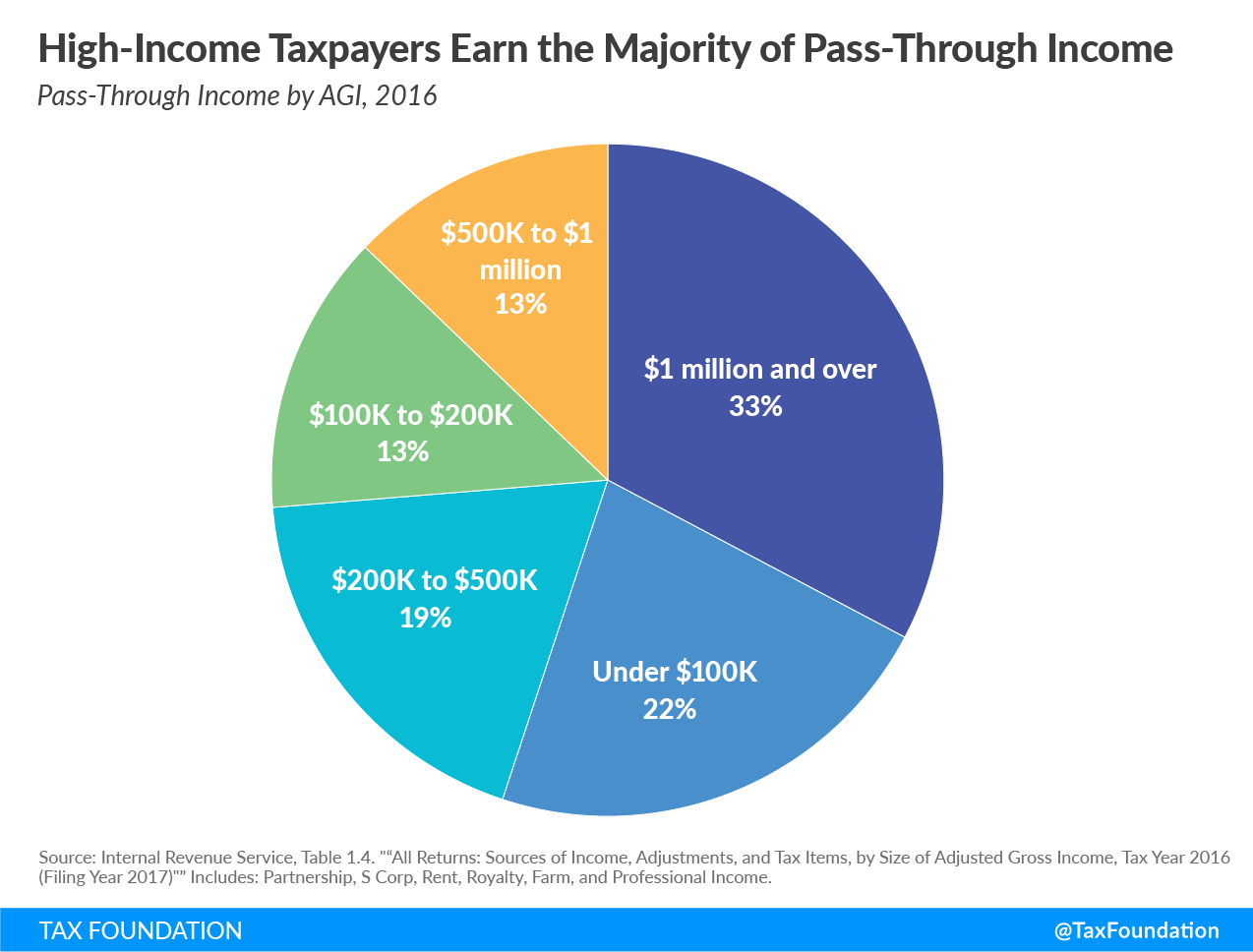

What Is A Pass Through Business How Is It Taxed Tax Foundation

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

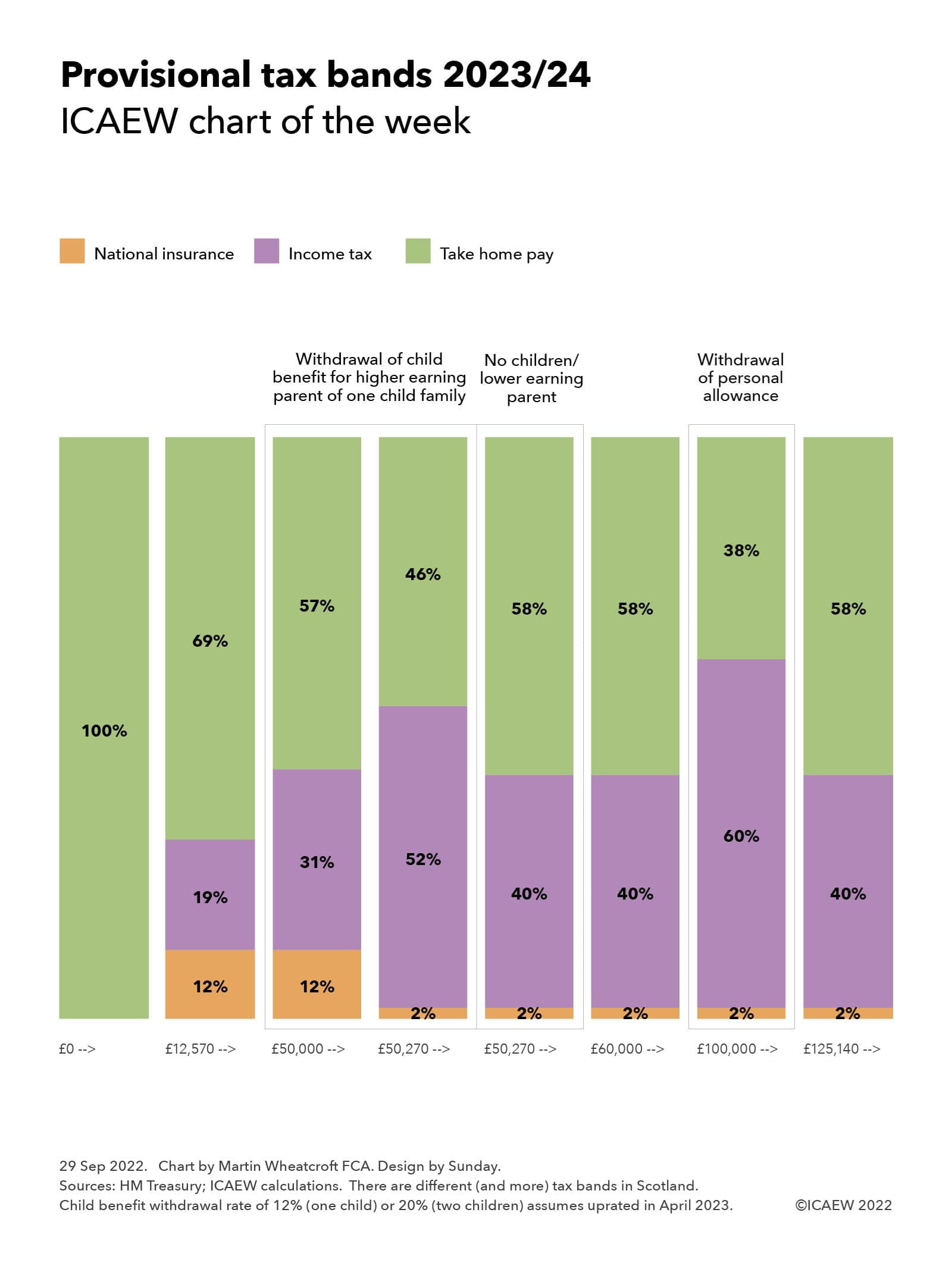

Chart Of The Week Provisional Tax Bands 2023 24 Icaew

Provisional Income Tax Due 26 February Do S And Don Ts For Companies

Part Iii Goods And Services Tax Amendment Act No 3 1988

How Big Is The Tax Code 2012 Version Don T Mess With Taxes

2021 Bond Election City Of Lewisville Tx

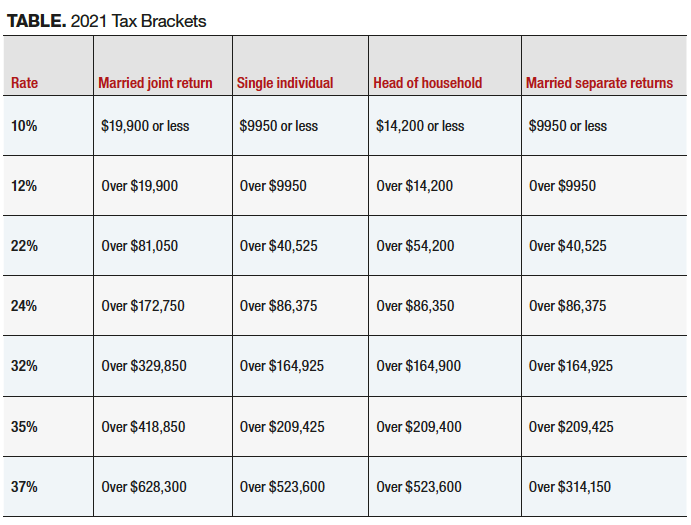

Tax Code In 2021 Take Note Of These Changes

Single Tax Code Project Ppt Download

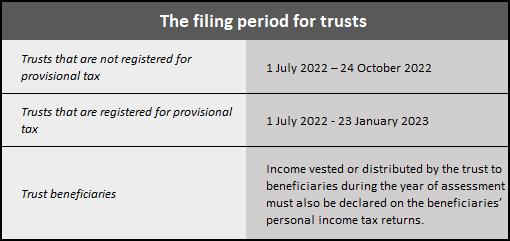

Is Your Trust Registered And Ready For Income Tax Roelof Oosthuizen Incorporated

Taxation Of Social Security Benefits Mn House Research

How To Calculate Provisional Tax Payments Guide And Calculator